Celtic bank issues The Surge Mastercard® and Credit Card which is serviced by Continental Finance. This is an unsecured credit card targeted to those with limited or poor credit. You will need to pay an annual fee with a starting credit limit of at least $300 with a potential increase in as little as six months. This credit card is an effective tool to build credit as the issuer reports your monthly payments to the three major credit bureaus. You can achieve your goal of improving your credit history, but it will cost you.

Table of Contents

Benefits of Surge Credit Cards:

- You can see if you’re Pre-Qualified with no impact on your credit score.

- You can apply all credit types.

- Get up to $1,000 credit limit doubles up to $2,000. You can simply make your first 6 monthly minimum payments on time.

- You can freely access your Vantage 3.0 score from Experian.

- This card monthly reports to the three major credit bureaus

- Get a fast and easy application process; you can get your results in seconds

- You can use your card at locations everywhere Mastercard is accepted

- Enjoy your Mastercard Zero Fraud Liability Protection

- Your checking Account is Required.

Pros and cons of Surge credit card:

Pros:

- Get potential unsecured card access

- This card monthly reports to three major credit bureaus.

- Enjoy $0 liability on unauthorized charges

Cons:

- Need to pay sky-high fees

- This card requires a security deposit

- Need to pay higher-than-average APR on purchases

- You will not get any rewards.

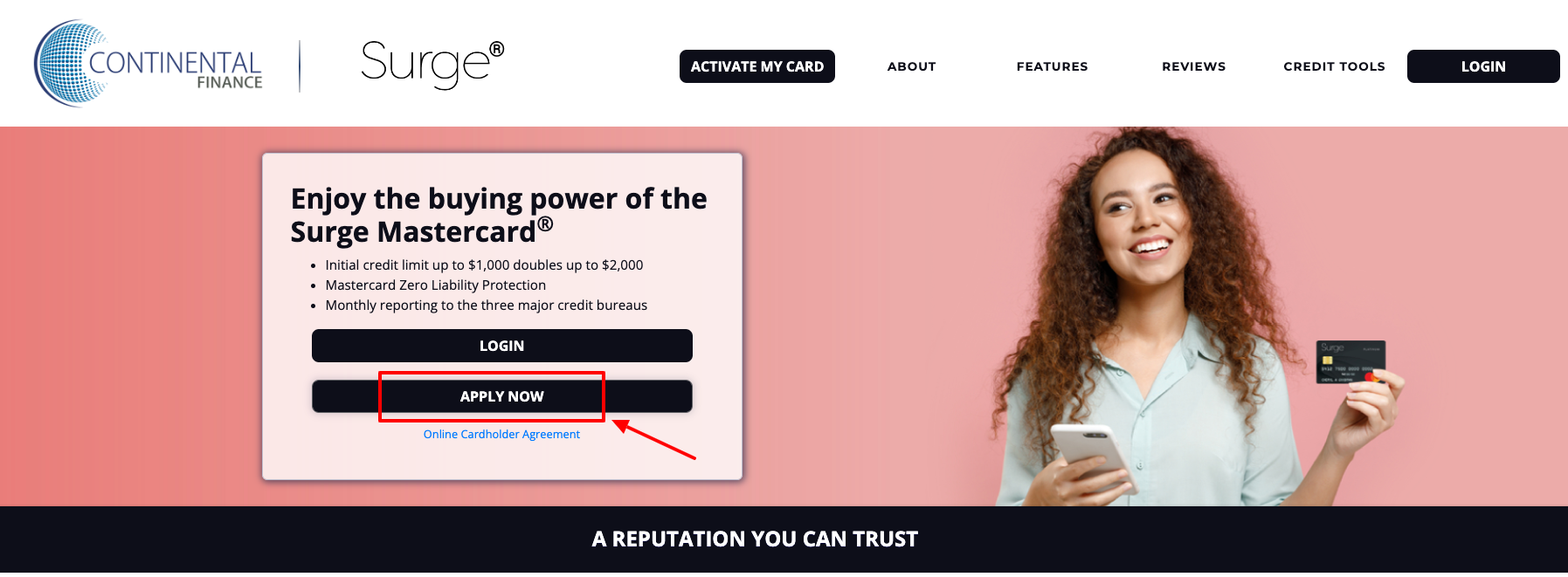

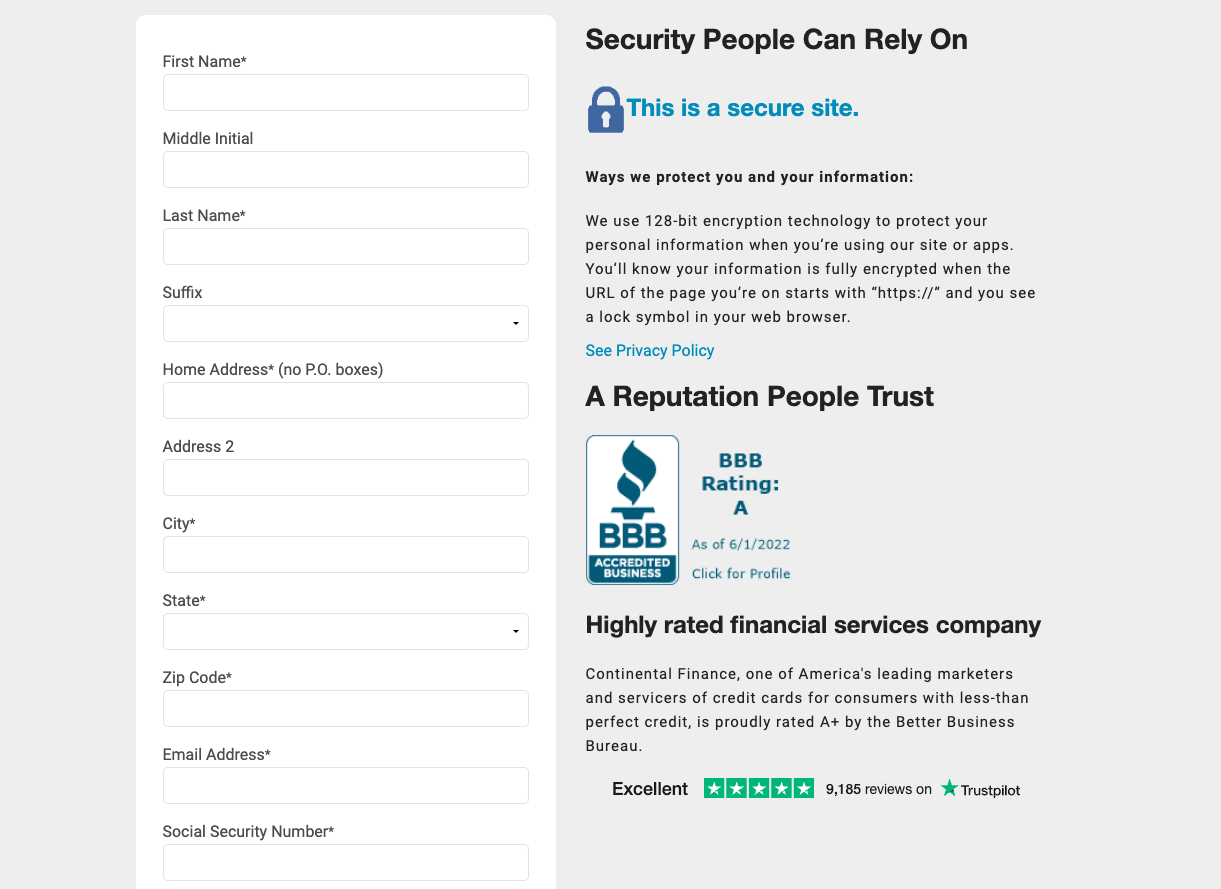

Surge Credit Card Apply:

Apply for your Surge credit card through the following steps.

- Visit www.surgecardinfo.com.

- Then click on the APPLY NOW button under the card.

- On the next page fill up a form.

- Enter your details as directed.

- Submit your form.

Eligibility for Applying for a Surge Credit Card:

- Applicants must have a Surge credit card’s online account.

- A valid phone number is required.

- The age should be 18 years of age.

- A good credit score is required to get this credit card.

Fees and Charges:

- One-Time Fees: $0

- Annual Fees: $75 – $99

- Monthly Fee: None 1st year, up to $10 after

- Purchase APR: 99% – 29.99% (Variable)

- Cash Advance fee: 5% (min $5)

- Cash advance APR: 99% – 29.99% (Variable)

- Foreign transaction fee: 3%

- Max late fee: $40

- Overlimit fee: $0

- Max penalty APR: None

- Grace period: 25 days

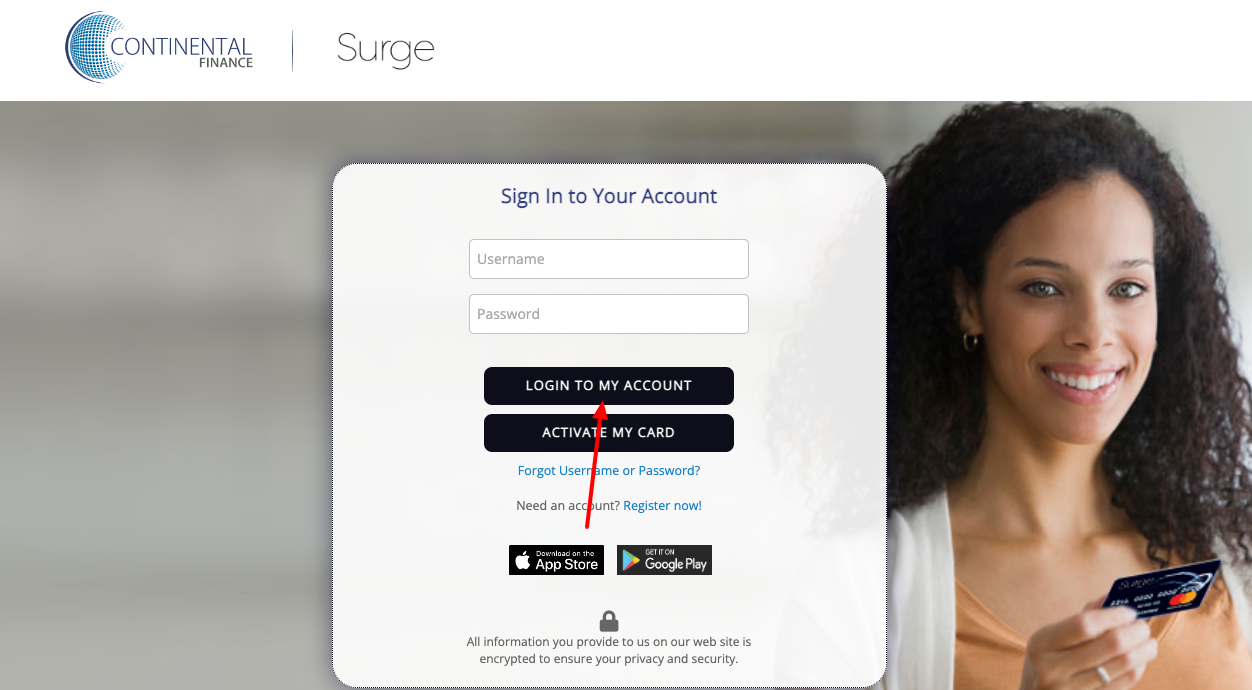

Surge Credit Card Activation:

Online method:

Go through these steps below to activate your card online.

- Switch on your computer or laptop.

- Visit www.surgecardinfo.com

- Sign in to your account and tap on the “Activate my card” option.

- Enter the details in the given place.

- Follow the instructions and verify your residential address.

- Then press the continue button and complete the activation process.

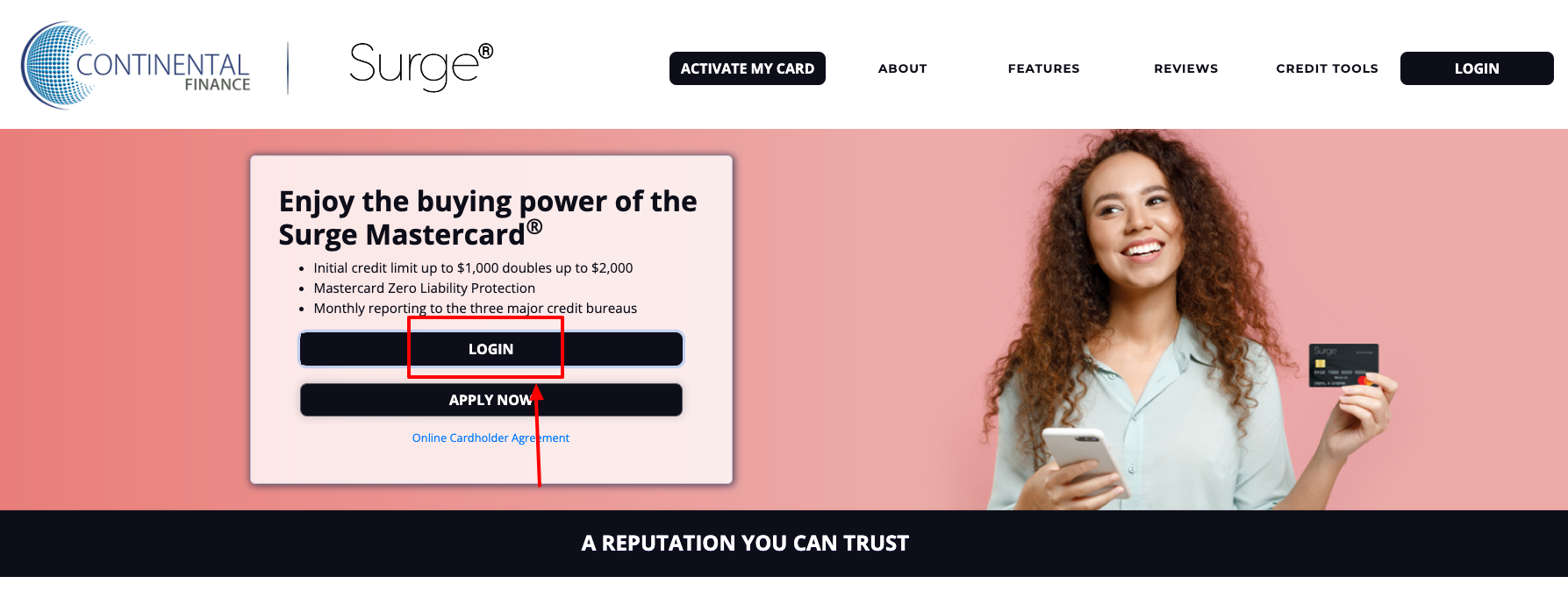

Surge Credit Card Login:

- First, go through the official website at www.surgecardinfo.com

- Click on the Login button.

- Type the user name and password in the given place.

- Finally, tap on ‘Login To My Account to continue.

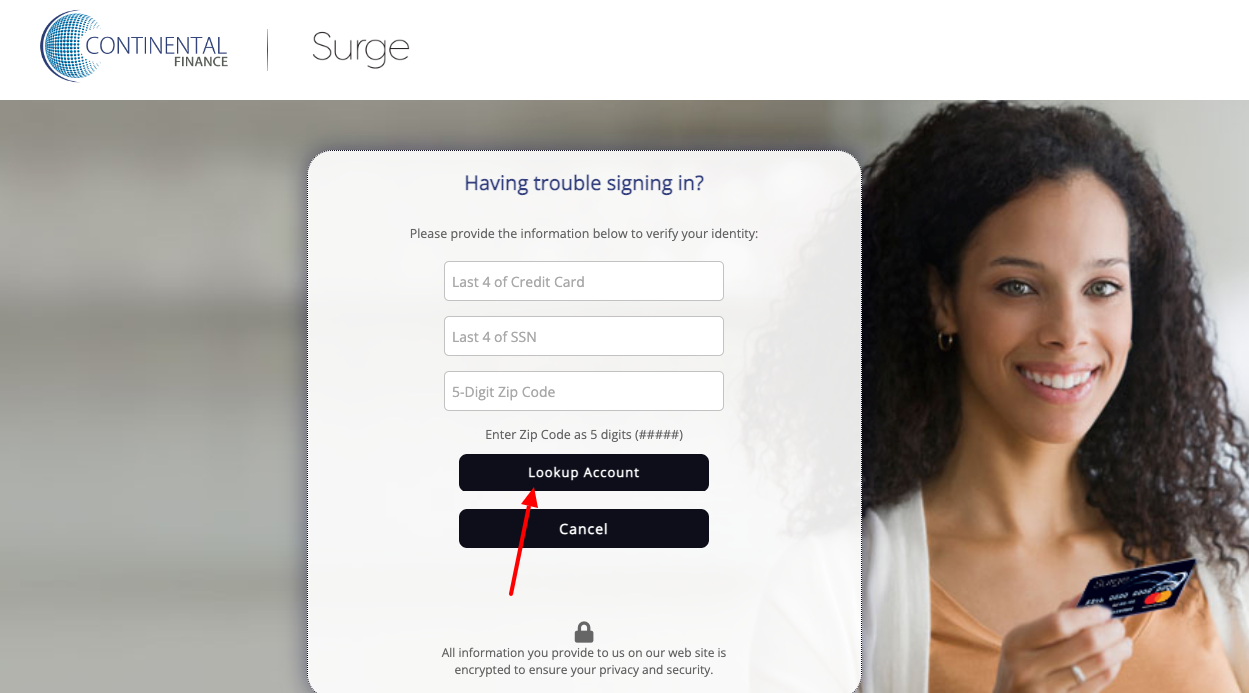

Surge Credit Card Password Recovery:

If you’ve forgotten any of your login details then don’t need to worry about it. You need to follow these simple steps for resetting your user’s name or password.

- Open the official website at www.surgecardinfo.com

- Click on the sign-in button and find the “Forgot Username or Password?” link.

- Enter required details and follow the on-screen instructions there.

- Finally, tap on the “Lookup Account” button.

- Reset your username or password easily.

Surge Credit Card bill payment:

You can use the Surge website or mobile app for making a Surge card payment online. You can also pay by phone, by mail, or at a branch. There you can also review your statements and account balance, can set up payment notifications, and manage your card. There you can also choose how much to pay when to pay it, and where the payment is coming from.

Online bill payment:

You’ll first need to set up online access and then log in through the site or app and set up a payment account like your savings or checking account.

- First Log in to your Surge Card account online at www.surgecardinfo.com

- Select “Payments” from the main navigation menu.

- There select “Make a Payment.” Option.

- You have to choose the “Add a bank account” option there and provide your account details.

- Then select a payment amount from the available options there and pay the minimum amount due, the full statement balance, the current statement balance, or enter another amount of your choosing.

- Select a payment date, or simply select “pay now” to send your payment on the earliest date available.

- Then choose a payment account from your available bank accounts.

- After that tap on “Review and Verify” to confirm the details of your payment.

- Finally, tap on the “Pay now” to make your payment.

- You can set a payment date, amount, and payment account to be used for each automatic payment by selecting a Repeat payment option.

Set Autopay:

- First, you will need to sign in to your account online.

- Then click on ‘Pay Bill’ in the top menu bar.

- After that tap on the ‘AutoPay’ option and then click on ‘Set Up’.

- Choose an account from the ‘Pay To’ selector if you have more than one account.

- Then choose your payment account from the ‘Pay From’ selector.

- After that select whether you would like to pay your Minimum Payment or Last Statement Balance.

- Then click on the continue button.

- Finally, you need to verify the details you selected are correct and click ‘Confirm’ to finish setting up AutoPay.

- You will get a confirmation notice with the start date of your first automatic payment.

- Pay at least your Minimum Payment for that month using a one-time payment to avoid a late fee if you set up AutoPay within 4 days of your Payment Due Date.

Also Read:

Access your Valero Credit Card Online at www.valero.com

Login to your Aviator MasterCard Online at www.aviatormastercard.com

How to Manage your Ford Service Rebate Card Online

Payment through mail:

If you want to use a check or money order but not cash, you can mail your payment in to Surge card’s. Put your card number on the memo or note field of your money order or check so the company applies it to the right account. Make sure to send it early enough that it will arrive by the due date. Mail it to

Surge Card

P.O. Box 3220

Buffalo, NY 14240-3220

Lock your Surge Credit Card:

You can instantly lock and unlock your Surge credit card if lost or misplaced to prevent it from being used for purchases from its mobile app. You just have to follow these few simple steps.

- Open your Surge card official website first www.surgecardinfo.com

- Log in with your credentials.

- Select the card you want to freeze.

- Then tap on the “Control Your Card” option.

- After that press the “Lock or Unlock this card” option there.

- Change the settings so that your card is in the locked position.

- You can navigate back to the Secure Hold page and unlock your card to use your card again.

Getting Started with Surge Credit Card:

Once you have activated your credit card then follow these steps to start using your credit card and optimize it to avoid fees, simplify your account management and earn rewards on your purchases.

- First download Surge mobile app to simplify your finances, track your rewards, lock your card in case you lose it and more.

- Set up your digital wallets, including Apple Pay, Google Pay, Samsung Pay, Garmin Pay and Fitbit Pay etc.

- Then enroll in online banking using your SSN or TIN and your credit card information which will allow you to monitor your accounts, make payments, set up virtual cards and more.

- Activate your Virtual credit card offered by Surge. This will keep your real card information hidden and secure. add the Eno from Surge extension from your browser and use it during online shopping.

- Set Up your PIN. You will get a personal identification number (PIN) along with your card. If you didn’t receive it or you want to change the old one then you will need to call at the number on the back of your card. This PIN can be use in ATM cash withdrawals and for purchases abroad.

Set up your Autopay. After signing in to your Surge online banking account select Pay Bills. Then select Payment options and then tap on Autopay option. This will help you to pay on time and avoid late payment fees.

Customer Support:

For general concerns, there is a customer support which will help you 24 hours a day, 7 days a week.

You can contact their customer service executives through these following details.

You can Call Customer Service at 1-866-449-4514

Surge Card

P.O. Box 3220

Buffalo, NY 14240-3220

FAQ:

How can you manage your online Surge account?

- You can enroll in Online Banking Service to do all of the following actions with your Surge card and more:

- Make a Surge credit card payment

- Enroll to receive online statements for your Surge card

- View recent transactions

- View previous statements

- View payment history

- View your balance and other important Surge credit info

When will you receive your credit card?

- It is a very fast process to get your brand new credit card after applying and approving your credit card. After approving your new Surge credit card and welcome materials containing important Surge card info will be mailed within (3) business days.

How can you check the status of my surge credit card?

- You can check your Surge Credit Card application status, call the issuer’s customer service department at 866-449-4514. You don’t get any online tool to check your application status.

What is a Continental Finance credit card?

- Cerulean Mastercard is one of a few credit cards by Continental Finance and is issued by the Bank of Missouri.

Is Cerulean credit card legit?

- The issuers of the Matrix card have now introduced another card in their offerings, called Cerulean. Applicants could either be approved for an unsecured card or a secured version. Like the Matrix card, this offering is targeted at those with bad credit.

Reference: