How to Apply and Log In for the Ashley Stewart Credit Card:

Ashley Stewart – An Introduction

Ashley Stewart is an American larger-size ladies garments organization and way of life brand, which was established in 1991. The name Ashley Stewart was propelled by Laura Ashley and Martha Stewart, who the organization saw as a symbol of elite Americana.

Presently the Secaucus, New Jersey-based organization has 89 stores spreading across 22 states in the United States. They sell various types of attire, going from dresses to jeans and shoes. Nowadays, the brand has made a rebound, in the wake of petitioning for bankruptcy in the year 2010 and also in 2014.

The organization Ashley Stewart was established in 1991 and immediately developed to more than 380 stores over 100 urban communities. They have recorded a yearly deal as high as US $400 million, which provoked numerous public retailers to follow after accordingly and aided change the metropolitan retail scenario. In the year 1996, the TSG Capital Fund II has made a financial investment of US $30 million in Ashley Stewart, which has helped the organization a lot.

The organization has always focused on holding occasions like fashion and style shows instead of getting into larger advertisement campaigning efforts. They would rather prefer to host 300 to 350 fashion style shows frequently in a year, which has helped them to fund-raise for the communities and networks they were in. Each Ashley Stewart store likewise recruited from inside the local area. The organization was perceived and appreciated by the United States President Bill Clinton for its commitment to the Welfare -to -work i.e PRWORA (Personal Responsibility and Work Opportunity Reconciliation Act of 1996) program.

Table of Contents

Step by step guide – How to Apply for the Ashley Stewart Credit Card:

The process of applying for the Ashley Stewart Credit Card is quite simple and requires a couple of moments. Whenever you are approved and received your account data, you can start enjoying all the benefits and advantages of your credit card account.

If you want to apply for the Ashley Stewart Credit Card, you need to follow the underneath steps:

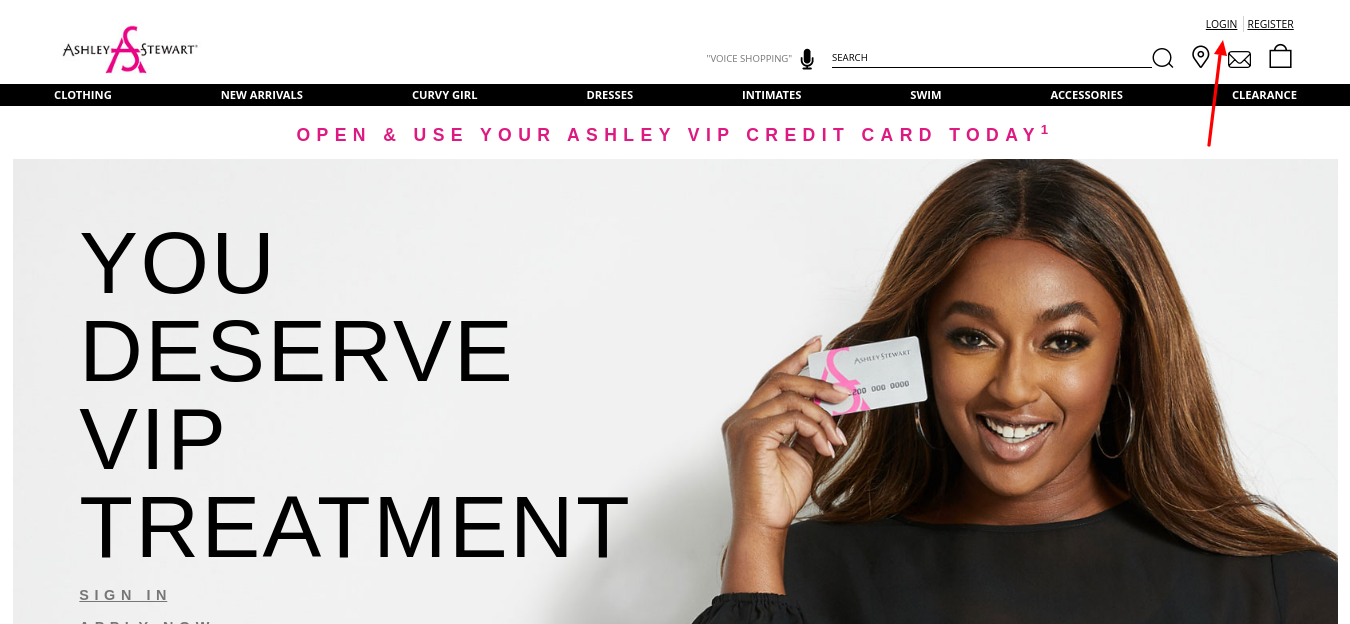

- Go to the authoritative website of Ashley Stewart company.

- Or you can click www.ashleystewart.com/credit-app-landing.

- Find and select the “Apply Now”, in the middle of the webpage.

- You will be flipped on a new page.

- Here put down your First Name, MI, Last Name, Date of Birth (DOB), Social Security Number (SSN), Email, Mobile Phone Number, Alternate Phone Number, Address, City, State, Postal Code, and Annual Income, etc.

- Now “Check” the box at the bottom (To agree for Terms and Conditions, Privacy Notice acknowledgment receipt, Consent for receiving documents online, and signing this application electronically, etc).

- Lastly, press “SUBMIT NOW”.

Step by step guide – How to Log In or Sign In for the Ashley Stewart Credit Card:

If you want to login for the Ashley Stewart Credit Card, follow the underneath steps:

- Go to the authoritative website of Ashley Stewart company.

- Or you can click www.ashleystewart.com/credit-app-landing

- Watch out for the “Log In”, in the top navigation bar.

- Flipped on a new page.

- Here you have to put your “Email Address” and “Password”, and tap the “SIGN IN” option.

- For SIGN IN you can use your FACEBOOK ID also.

Step by step guide – How can I Reset or Change the password for Ashley Stewart Credit Card:

If you have forgotten your password, the company will send you an e-mail to your registered email address to help you out. If you want to do the process now, please follow the steps below:

- Tap on the “Log in” button, in the top navigation bar.

- Directly under the “Sign In” field is a link that says “Forgot Your Password”.

- On the Forgot Your Password screen, you will be prompted to put down your email address.

- After putting down your email address, tap on the “SEND” button.

- The company will primarily send you an email with a temporary password. For more security reasons, your original password will be reset by the companies own system.

- Tap on the link given in the email you have received.

- Now you will be required to enter your new password.

- Press the “Log in” button, in the header of the authoritative website, again and log in using your fresh new password. You can now make your purchase as you normally would.

Please Note: The password for your account is case-sensitive.

Also Read : Manage your Lane Bryant Credit Card Online

Ashley Stewart Credit Card:

Eligibility Criteria:

- You must be at the majority of your age, in your province or state.

- Must have a government-approved valid Photo Identity.

- Have a government-issued valid Tax Identification Number, like Social Security Number (SSN) or Social Insurance Number (SIN), etc.

- You must have a Street, Rural Route, or Army Post Office (APO), Fleet Post Office (FPO) address for mailing.

Please Note: Ashley Stewart does not accept Post Office (PO) Box address for mailing.

Features and Benefits:

- You can take the benefit of a 20% discount on your first purchase, using the card.

- Avail secret sales VIP Card exclusive sales and offers

- Get the benefit of free shipping, all year long.

- Access the 20% off Birthday coupons and surprise gifts to celebrate in your style.

- You get early access to shop for the new collections, special offers, and sales, etc.

- As a card member, you can join the Ashley Stewart VIP email group for details.

- Simply access your account through online and toll-free customer care service at (800) -376 -0581 (TDD/TTY 1 -800 -695 -1788).

Rates and Charges:

- Annual Fee – Introductory $0 (No fee). (Please Note: In any case that there is an Annual Fee, this expense will be charged at the end of your first billing period and every year from that point. The company will refund this expense on the off chance that you close your Account within 30 (thirty) days of the delivery or mailing date of the bill on which the fee shows up. The Annual fee charge is generally non-refundable).

- APR for Purchases – 24.99% (This Annual Percentage Rate is variable based on the Prime market rate).

- Late Fee – $29 to $40 (Please Note: In case that you don’t pay the Minimum Payment within the Due Date, the company can charge a Late Fee. The charges normally are $29, in case that you were not charged a Late Fee during the earlier six billing period, or else, it will be $40 (max). This expense won’t surpass the maximum amount as allowed by country law).

- Returned Payment Fee – $29 to $40 (Conditions same as Late Fee will be applied).

- Alternative Payment Method Fee – $15 (Please Note: The company may permit you to make an assisted payment of your bill via telephone. In that case, they may charge an Alternative Payment Method Fee. Right now, that charge is up to $15. The company will inform you of the current fees before you make any payment and you can pull out your request in the case that you would prefer not to pay the expense).

- Minimum Payment – You can pay the whole Billing amount balance at your convenience. You have to pay the Minimum Amount Payment for each billing period within the Due Date mentioned on your statement.

- Minimum Interest Charge – If you need to pay the interest, in any case, the charges are not less than $2 on each credit plan.

Contact Details of Ashley Stewart:

For General Queries:

Comenity Bank (As Ashley Stewart Credit Card is issued by Comenity Bank)

P.O. Box – 182273, Columbus, OH 43218 -2273

For Credit Reporting Disputes:

Comenity Bank,

PO Box 182789, Columbus, OH 43218 -2789

Phone Numbers:

Credit Card Customer Care:

Ashley Stewart: 1 -800 -376 -0581

TDD / TTY: 1 -800 -695 -1788

Reference Link:

www.ashleystewart.com/credit-app-landing