How to Get Ally CashBack Card Servicing

Ally Financial Inc. gives different budgetary items and administrations to shoppers, organizations, car sellers, and corporate clients basically in the United States and Canada. It works through Automotive Finance Operations, Insurance Operations, Mortgage Finance Operations, and Corporate Finance Operations fragments. The Automotive Finance Operations section offers car financing administrations, including giving advances, retail payment deals, and working leases, , financing seller floorplans, different credit extensions to vendors, term advances to vendors and distribution center lines to car retailers. It additionally offers financing administrations to organizations and districts for the buy or rent of vehicles and vehicle-remarketing administrations.

The Insurance Operations fragment gives buyer fund security and protection items through the car vendor channel, and business protection items legitimately to sellers. The Mortgage Finance Operations section oversees held-for-speculation customer contract money advance portfolio that incorporates mass acquisition of kind sized and low-to-direct pay contract advances started by outsiders, just as immediate to-shopper contract contributions. The Corporate Finance Operations portion offers senior verified utilized income and resource-based credits to center market organizations.

Ally is positioned nineteenth on the rundown of biggest banks in the United States by resources, is the biggest vehicle fund organization in the U.S. by volume, and serves more than 6 million clients. Through its SmartAuction online commercial center for auto barters, propelled in 2000, the organization has sold in excess of 5 million vehicles, incorporating 281,000 vehicles sold in the year 2018.The organization was established in 1919 by General Motors as the General Motors Acceptance Corporation to give financing to car clients. In the year 1939, the organization established Motors Insurance Corporation and entered the vehicle protection advertise.

At the point when an organization discharges another cashback Visa it is to everybody’s greatest advantage for there to be an approach to deal with the new card accounts on the web. Ally has this idea as it is offering its Ally CashBack Credit Card to clients advantageous online record the board through the Ally CC Servicing page. To pick up an account get to clients should login by entering a username and secret word (clients might be required to respond to a couple of security questions while signing in). Cardholders that presently can’t seem to pursue account access will initially need to finish an unbelievably basic online enlistment. Those that have overlooked their username and secret key can recover their record by utilizing the proper connections gave on the Ally CC Servicing page.

About Ally CashBack Credit Card

All together for a solicitation a credit limit increment to be viewed as the record must be open for at any rate 6 charging cycles (a refreshed credit report will be required also)

Cardholders hoping to close their record might be mentioned to give composed notification to Credit Card Servicing at P.O. Box 84037, Columbus, GA 31908-4037

Balance moves from other charge cards are permitted as long as far as possible is sufficiently high to cover the offset being moved alongside any exchange expenses

Payments might be made online at the Ally CC Servicing page, by top notch mail, by calling Ally Customer Service, or by postage paid ahead of time

Credit limits for the Ally CashBack Credit Card can be found by investigating the month to month account explanation or by calling Ally client support

At the point when its opportunity to recover those sweet rewards clients may do as such by setting off to the Ally CC Servicing page and tapping on reclaim rewards. Cardholders should take note of that the base recovery for capitalizing on the prizes earned through the Ally CashBack Credit Card is $25.

Rates of Ally Cashback card

15.24%, 20.24% or 25.24% Purchase APR

Balance transfer APR is 0% intro for the first 12

Balance transfer fee is $5 or 3%

Cash advance rate is 25.49% variable

Cash advance fee is $10 or 5%

Foreign transaction fee is 3%

Late payment fee is Up to $35

Features of Ally Cashback card

Get up to 2.2% cashback at grocery stores and gas stations.

Avail up to 1.1% cashback on other purchases.

Enjoy $100 Welcome offer

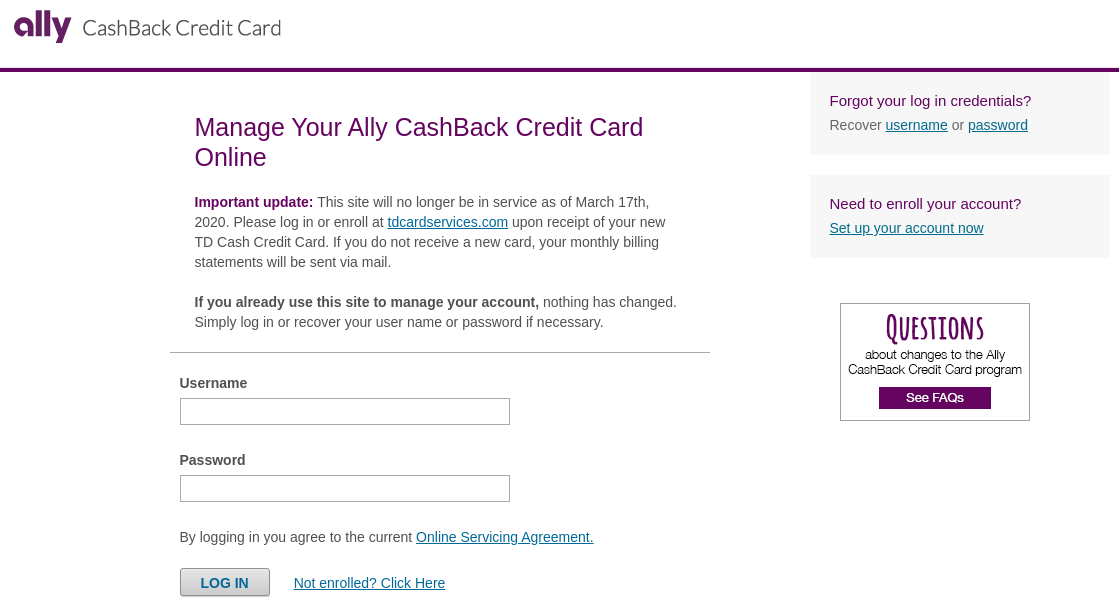

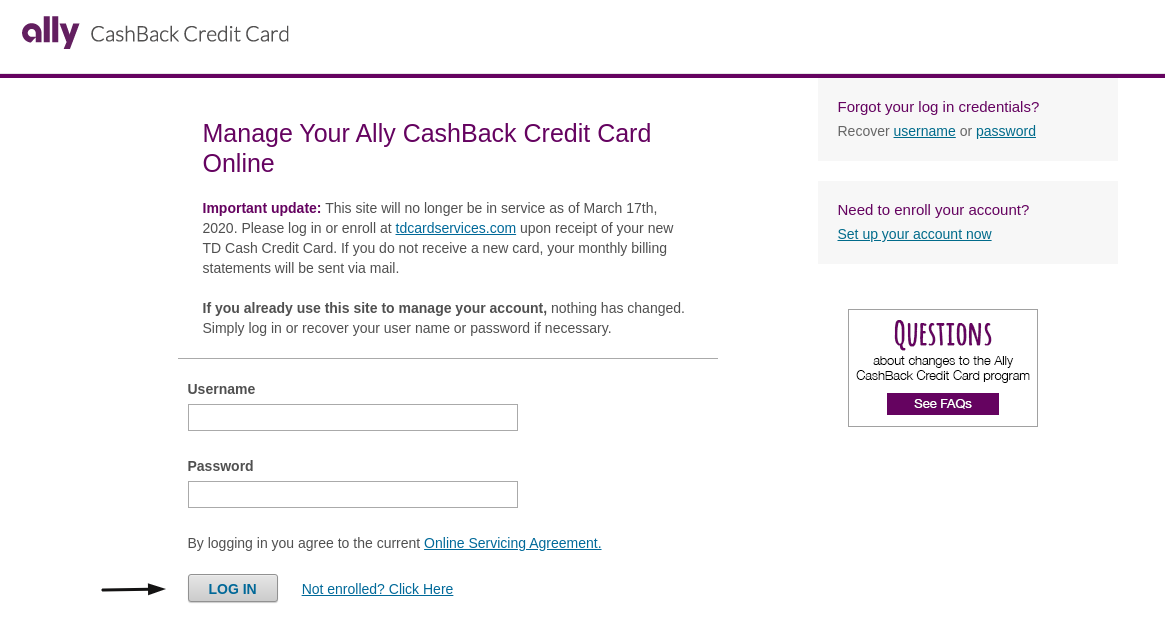

Manage your Ally Cashback card

For this go to, www.ally.ccservicing.com

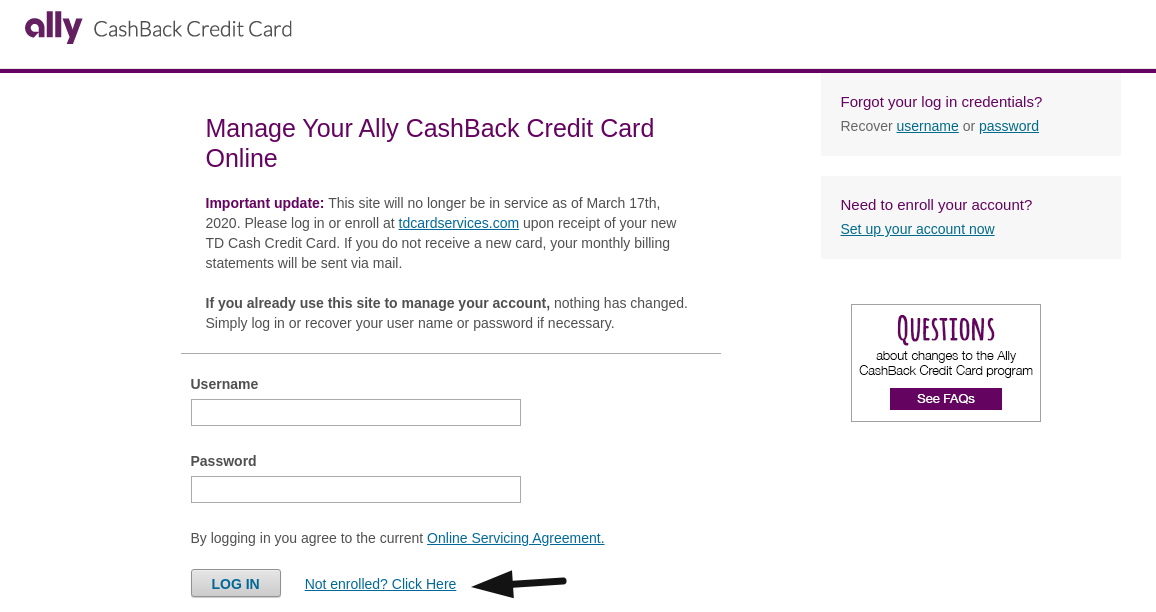

At the middle on the left side you will get the login blanks, and under that click on, ‘Not enrolled? Click here’. Here, type,

Account Number*

Social Security Number

Name on Card*

Date of Birth*

Month Day Year

Zip/Postal Code*

Security Code*

Then, click on, ‘Verify account’.

Login with Ally cashback card

To log in go to, www.ally.ccservicing.com

At the middle on the left side, you will get the login blanks, here enter,

The username

The password

Then, click on, ‘Login’.

Recover password

To recover the password click on, ‘click here to recover password’, then enter,

The username

The password

Then, click on, ‘Next’.

You have to check your prompts after this to get back the details.

Customer care

To get more support call on the toll-free number, 1-888-916-2559. (24/7)

Reference :