AgFed Credit Union – An Introduction:

Agriculture Federal Credit Union (AgFed) was started in 1934, in Washington, DC, and now serves people across the country. Giving the highest caliber of service is their main concern. The organization offers market-driving home loans, automobile loans, credit cards, checking, and a wide scope of different accounts in light of the customer’s advantages consistently.

AgFed Credit Union is governmentally safeguarded by National Credit Union Association (NCUA), USA and is an equivalent housing loan specialist.

The organization is well equipped with more than $326 million in resources, more than 25,000 customer members, and 8 AgFed branches, here individuals approach their records and their services 24 hours per day, 7 days every week.

The organization AgFed Credit Union greets many new individuals consistently and would adore for you to go along with them as well.

Table of Contents

How to Log In for AgFed Credit Union Visa Classic Credit Card:

To Log In for AgFed Credit Union Visa Classic Credit Card, you have to follow the below steps:

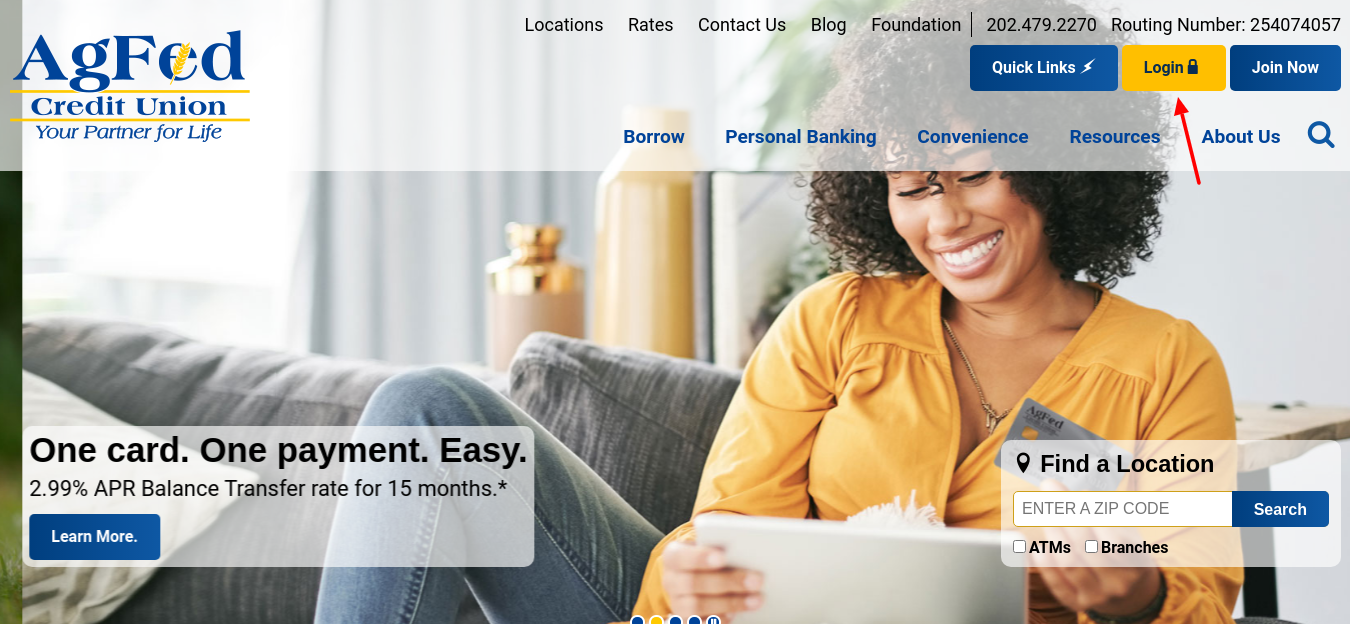

- Go to the official website or click on www.agfed.org.

- Search and tap “Login” on the page, and again tap “Login” in a new window.

- On a new webpage, put your “User ID” and “Password”, under the Secure Login headline.

- Now press the “Continue” button.

How to Apply for AgFed Credit Union Visa Classic Credit Card:

To Apply for the Classic Visa credit card, you need to follow the steps:

- Visit the official website or click on www.agfed.org

- Find and tap “Borrow”, and then tap “VISA Credit Cards”.

- Then on a new webpage, find and press “Visa Classic” on the left.

- Now on the Visa Classic webpage, press “Apply for a Loan”.

Apply via Phone:

To apply using the phone is simple, quick, and convenient. You can connect to the Customer Service helpline at 888 -451 -5626. You can also apply through any of the organization’s branches nearby.

How to Activate an AgFed Credit Union Visa Classic Credit Card:

For Activation, you have to call the “800” number given on the front side sticker of your credit card. Presently, it is not possible to activate your card online.

How to Enroll or Register for an AgFed Credit Union Visa Classic Credit Card:

- Follow the Log In process above, (first 2 steps).

- On the new Log In the window, you will find and click on the “Enroll” tab.

- Now on the Agreement page, click on the checkbox (To accept the terms of Agreement).

- You are on the “Enrollment Page”, here put your Last 4 (four) Digits of Social Security Number (SSN), Birth Date, Account Number, etc.

- Press “Submit”.

How to Reset Forgot Password for AgFed Credit Union Visa Classic Credit Card:

- To Reset Forgot Password, follow the login process first.

- On the Secure login page, you can find and press the “Forgot Your Password” option.

- Here on the Forgot Password webpage, you have to put your User ID, Last 4 (four) Digits of Social Security Number (SSN), Birth Date, etc.

- Now, press “Submit”.

AgFed Credit Union Visa Classic Credit Card:

Regardless, of where life takes you, you can depend on AgFed’s low rate VISA Classic Credit Card, to give you the adaptability you need.

The AGFed Credit Union Visa Classic Credit Card is accessible to Federal Team individuals. Cardholders can deal and track their online records from the convenience of their homes or workplaces on their smartphone without any disturbances.

This Visa Classic Card additionally gives its customers simplified web-based financial practices. As a cardholder, you can get to and deal with your Visa card from any gadget because the process of sign-up has been improved.

Eligibility Criteria:

- Your age is a minimum of 18 years or more.

- American Citizenship

- Your Social Security Number (SSN)

- Approved U.S Government Photo ID (like Passport, Drivers License, State or Military ID, etc)

- Member of Agriculture Federal Credit Union.

Also Read : Access to your Fifth Third Bank Credit Card Online

Features and Advantages:

- The Cash access process is quite simple, you can create your PIN and access cash quickly.

- Your trips are covered by travel insurance, using this card.

- You can avail of a 25 (twenty-five) days grace period for payment, on transactions.

- Get protected for your loan payment.

- Access your online banking for Free (24 X 7).

- Avail of a credit access facility up to $10,000, with this card.

- Globally accepted, due to VISA card.

- Cash Advance flexibility for 24 hours.

- Customer Service assistance for (24 X 7).

- Avail VISA Purchase Alerts system through text messages, emails, to keep track of your transactions.

Rates and Interests:

- Avail a $0 (No Fee) Annual Fee.

- No fee ($0) on Transfer of Balances.

- Foreign Transaction Charges are $0 (No Fee).

- You have to pay an introductory 2.99% Annual Percentage Rate (APR) on the balance transfer rate, applicable for the first 6 (six) months.

- Pay a low-interest rate of 14.65% APR on your purchases.

- A 3% transaction fee is applicable for Cash Advances.

Contact Details:

Agriculture Federal Credit Union

P.O. Box – 2225, Merrifield, VA 22116

Phone Numbers:

For Apply Credit Card (Call): 888 -451 -5626

For Lost or Stolen Credit Card (Call): 800 -449 -7728 or 800 –VISA911 (24 Hrs, 7 days)

For Expired and Not Received Credit Cards (Call): 202 -479 -2270 or 800 -368 -3552

Reference Link