Login to Your Union Bank Account:

Union Bank works in the buyer, independent company, center market, land, corporate, reporter and exchange money markets, and furthermore gives venture and private banking, monetary administration, protection, trust administrations, and worldwide authority administrations. Its industry center is focused basically around the public utilities, media, interchanges, diversion, energy, and retail areas. There are four significant business lines at Union Bank. Individual financial offers reserve funds, checking, home value, retirement arranging, web-based banking, and domain intending to retail clients.

The abundance the executive’s division gives ventures, trust organization, business administrations, and protection. Independent company administrations incorporate vendor card administrations, money the executives, business financing, and Internet banking, Union Bank additionally gives concentrated private venture administrations to philanthropic associations and organizations possessed by ladies and minorities.

Table of Contents

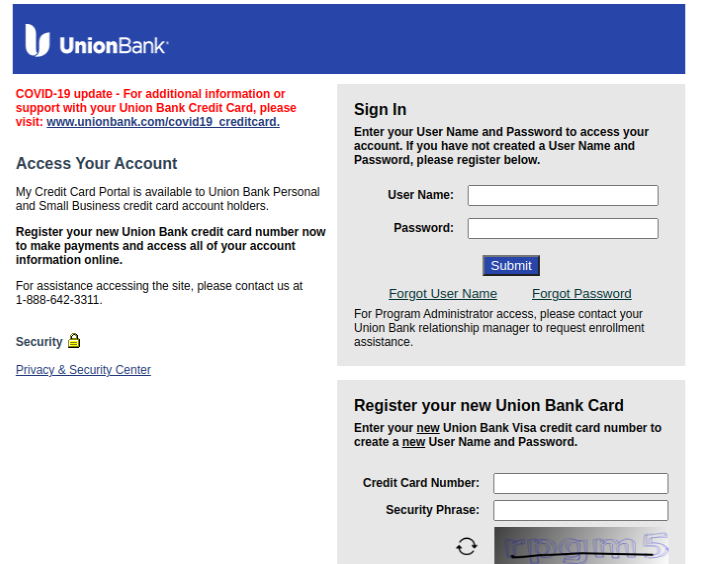

Union Bank Login:

For the login open the page, mycreditcard.unionbank.com

- As the page displays at the center, you have to provide,

- The username, password, click on, ‘Submit’ button.

How to Reset Union Bank Login Information:

To reset the login details, open the page, mycreditcard.unionbank.com

- After the page opens, under the login spaces, tap on, ‘Forgot username’ button.

- In the next screen, provide, card details, the last four numbers of social security, zip code, enter the security phrase, click on, ‘Next’ button.

- For password recovery, enter a username, click on, ‘Next’ button.

How to Register for Union Bank Account:

To register for the account, open the page, mycreditcard.unionbank.com

- As the page appears, at the center, you need to provide,

- The credit card number, security phrase, click on, ‘Submit’ button.

Also Read : Access to Merrick Bank Paperless Account

Some important Services of Union Bank:

- Bank account: Offers 10 kinds of bank account to its clients with zero least equalization necessities. Clients can connect their records to fixed store plans to acquire high intrigue. Understand More

- Current Account: Association Bank of India offers 6 kinds of the current record to its clients with low least parity prerequisites, and offices like web banking, assignment, and so on

- Home Loan: Union Bank of India offers 6 sorts of home advances to its clients with adaptable strategies for low preparing charges, reimbursement, low-financing costs, and basic documentation. Understand More

- Individual Loan: Union Bank of India offers 4 sorts of individual credits to its clients for non-salaried people, salaried, government representatives and a lot more at adaptable residencies and appealing financing costs. Understand More

- Advance Against Property: Union Bank offers 3 kinds of credits against property with the base quantum of advance of 5 million Customers can benefit advance against property at low EMIs and adaptable residencies.

- Vehicle Loan: Union Bank of Indian offers a vehicle advance to its clients at low-financing costs, low EMIs, less administrative work, and snappy dispensing. The bank offers the advance for the longest residency of 7 years.

- Check Card: Union Bank of India offers 6 sorts of charge cards to its clients. Each check card accompanies a great deal of adaptable withdrawal limits, benefits, compensations on shopping, voyaging, and so on

- Parity Enquiry: Union Bank account holders can utilize its passbook, net banking, missed call administration, complementary number, portable banking, SMS banking, ATM to check their record balance in a flash.

- Net Banking: Using the Union Bank of India Net Banking office, the record holder can without much of a stretch check their record balance, move assets inside and outside the bank, and some more.

Union Bank Contact Help:

To get more support, you can call on the toll-free number, 1-888-642-3311. Or write a letter to, PO Box 51442 M/C V03-955 Los Angeles, CA 90051.

Reference Link: