Personal Capital vs Mint: Which One is Better?

Personal Capital and Mint Overview:

The basic thing about financial advice is to create a budget or same some for retirement and plan for the financial future. However, some people don’t have a basic idea of this basic thing. You will not get the info on personal finance in the school. So, you have to figure the information on personal finance on your own. But there are certain apps, which will help you on your quest. Personal Capital and Mint are both very popular tools to help people to find out where they are spending. They also determine how they are going to start making changes for your long-term benefits.

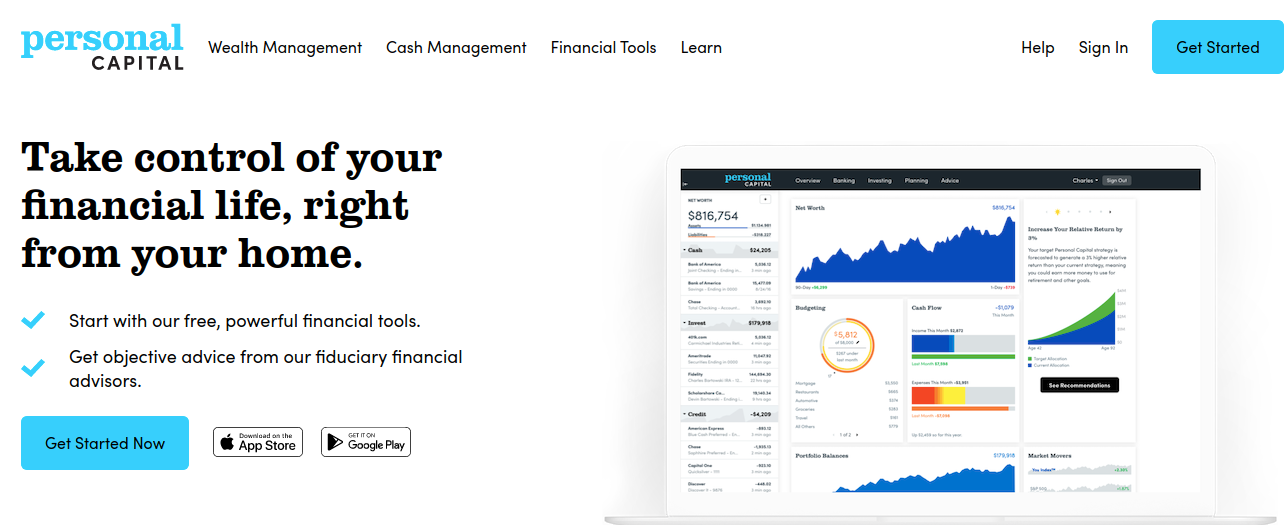

About Personal Capital:

Personal Capital was first started in 2009 and until now, they already have served over 2 million users. They manage over $9 billion in assets.

There are mainly two services that Personal Capital offers. The one is the paid version that acts more like the robo-advisor. It is a perfect choice for the people with over $200k in the investment assets. The other service is the free version, which can be used by almost anyone. Here in this article, you will focus on the free version of PC, that offers a lot of features.

The main focus of the Personal Capital is on your investment tacking, your net worth, and help you to prepare for your retirement. With the Personal Capital, you will get some excellent tracking and analysis tools, that are available for both free and paid versions. For example:

- Asset allocation tool

- Retirement planner

- 401(k) fee analyzer

- Investment Checkup

About Mint:

Mint was started back in the year 2006. In 2009, it was acquired by the Intuit. Until now, they have over 10 million active users. Every year, they make around 250 billion transactions.

To provide an overview of your finances, Mint offers a variety of personal financial tools. Such as the:

- Spending analysis

- Bill pay reminders

- Budgeting

- Credit monitoring

Here you will also get the goal setting and tracking tools, but they are not that not as much excellent what Personal Capital offers.

Table of Contents

The Different Between Personal Capital and Mint:

We will explain to you some of the most important components of both of these apps, which will help you to decide which will be the best money tracking tool.

Signing Up:

Sign Up process for the money tracking tools is almost the same, and Personal Capital and Mint are not exceptional. To set up your free account, you will require your email ID and password. Then, there are a few minor differences, that you have to follow:

Signing Up for Mint:

- To verify your account’s safety, Mint will ask you about your cell phone number. Although, it isn’t required.

- You have to provide your country name and the zip code. Using your provided details, Mint will find some of the best offers for you.

- In case, if you have an account on the other Intuit products, such as the TurboTax and Quicken, then you can use the same account.

Singing Up for Personal Capital:

- During the sign-up process, you have to provide your cell phone number to ensure your account’s safety.

- There, you also have to provide your basic details like your name, age, planned retirement age and account saved. Those details will help you to starts the build a personalized retirement plan for you.

Linking Accounts:

After creating the account, you have to link your account with the financial accounts. You have to like your account to get the best picture with either money tracking tools. For example:

- 401(k)

- Mortgage

- Credit card accounts

- Investments

- Checking and savings accounts

- Student loans

- Cars

- IRA

- Property

- Other retirement accounts

With both of the apps, you will get some most used and largest financial institutions. You can even search for the institutions that are not on the list. But make sure to link your account from micro-savings or micro-investing apps, such as the Qapital, Acorns, and Stash.

During the sign-up process, if you need to take a break or forgot anything, you can easily pick that up with the Personal Capital. Simply click on the plus sign at the top right-hand side of your dashboard. Then, you can like what you have missed.

But with the Mint, you might have to face a coupon of issues. After you are done linking one investment account, you might not get an option to add another. Mint will ask you to click on the Invest Now with Fewer Fees option. That will take you to another page with the different brokerages.

So, in the filed of linking your accounts, Personal Capital wins.

Also Read : Access To Navy Federal Credit Union Account

Synchronization:

The most important thing about the money tracking app is to see everything in one place. But, if you have to log in to your checking account and then credit card companies, that will be annoying. If you get everything at once in front of you, that will be helped.

With the Mint, many users have faced the issue of synching their transactions.

But with the Personal Capital, you will get to see the completed transaction that you make with your checking account. If you are hoping to use one money tracking tool, then it will be important stuff.

So, get to see the clear winner is Personal Capital.

Bill Management:

With the Mint you can set you the bill payment reminder. They did have the bill payment features on their app. But that was canceled.

Whereas, to remind you, Personal Capital brings the due dates from your linked account. But unlike the Mind, you cannot set up a bill payment reminder.

So, it will be a tie between the Mind and Personal Capital.

Customer Service:

Personal Capital is known for providing the best customer service to its users. You will get the Help option on the bottom right corner of the screen. If you cannot get the answer to your questions, then you can simply click on the Contact Us option. You will get the Contact Us option within the Help screen.

You can even email about particular institutions or services, upload files, etc. Within 24 hours you will get the response from the Personal Capital.

Mint offers the chat service, but that is more like the email support help. It is not that fast and you might not get it incredibly helpful.

Personal Capital wins again for their customer service.

Security:

In terms of security, both Personal Capital and Mint are excellent choices. Both of these apps, keep your accounts and information safe.

- Personal Capital and Mint, both money tracking tools are read-only apps. That means, no one can deposit or withdraw money using these apps.

- They do not display your name or account number on your screen.

- Here you will get the same level security that used by the top financial companies.

- Through the support Apple devices, you can use the fingerprint login service. Which gives an extra layer of protection to your data.

With the multi-factor authentication, Mint goes one step further. With Personal Capital, you might not get those features.

Personal Capital and Mint, both are secure money tracking apps. But I had to choose between these two, then I go for the Mint.

How They Make Money:

Both of the money tracking apps (Personal Capital and Mint) are free. But with the Personal Capital, you will not get any annoying ads. They usually make money offering high-level investment services. So, even in the free version, you will not get any ads and that is great.

In Mint, you will get to see several offers outside financial services and that is how they make money.

Personal Capital’s Retirement Planner:

The Retirement Planner is another important feature, that comes with the Personal Capital. This feature of Personal Capital works by analyzing these following things:

- Your net worth.

- Your contribution towards your retirement account.

- Info from your all linked accounts.

- Planed age of retirement.

Putting all these things together, Personal Capital will show you your ideal age for retirement. It will help you to find the best plans for your retirement. In case, you fall behind on savings for your retirement, it will be a huge wake-up.

Conclusion:

Overall, both of the tools are great in their classes. But if we have to choose between these two money tracking tools, then Personal Capital is the one. If you are interested in retirement planning then the Personal Capital will be a perfect choice. The overall look of the Personal Capital is another reason to choose.

But that doesn’t mean, Mint is a bad option. Here, you will get some exciting budgeting tools. So, if you are interested, then you should once check the Mint.

If you still have confusion, then you can simply try both of them. As we said, both of these apps are free, so there is nothing to lose, at least not your money.

Reference Link:

Personal Capital: www.personalcapital.com

Mint: www.mint.com